In our last two blogs, we found that index providers FTSE and MSCI currently disagree on how to classify Korean markets (as well as a few other smaller countries’ markets). FTSE allocates Korean stocks to its developed markets indices, while MSCI allocates them to its emerging markets indices.

Market Classification:

| Country | FTSE | MSCI |

|---|---|---|

| Korea | Developed | Emerging |

| Poland | Developed | Emerging |

| Kuwait | Emerging | Frontier |

We also learned that the iShares international and emerging markets equity ETFs follow the MSCI indices, while the Vanguard international and emerging markets equity ETFs follow the FTSE indices.

Today, I’ll stick to the Canadian-listed ETFs, but this discussion also applies to their U.S.-listed counterparts.

| Tracking ETF | Symbol | MER (%) | Underlying Index | Number of Stocks | Dividend Yield (%) |

|---|---|---|---|---|---|

| iShares Core MSCI EAFE ETF | IEFA | 0.08% | MSCI EAFE IMI Index | 3,268 | 3.6% |

| iShares Core MSCI EAFE IMI Index ETF | XEF | 0.22% | MSCI EAFE IMI Index | 3,268 | 3.6% |

| iShares Core MSCI Emerging Markets ETF | IEMG | 0.14% | MSCI Emerging Markets IMI Index | 2,712 | 2.9% |

| iShares Core MSCI Emerging Markets IMI Index ETF | XEC | 0.26% | MSCI Emerging Markets IMI Index | 2,712 | 2.9% |

| Vanguard FTSE Developed All Cap ex North America Index ETF | VIU | 0.23% | FTSE Developed All Cap ex North America Index | 3,675 | 3.5% |

| Vanguard FTSE Emerging Markets ETF | VWO | 0.14% | FTSE Emerging Markets All Cap China A Inclusion Index | 4,032 | 3.1% |

| Vanguard FTSE Emerging Markets All Cap Index ETF | VEE | 0.24% | FTSE Emerging Markets All Cap China A Inclusion Index | 4,032 | 3.1% |

So, why does it matter where each index happens to allocate its Korean stocks? Given the different treatments, if you don’t pair up your portfolio properly, you could end up accidentally doubling your exposure to Korean companies … or, on the flip side, omitting it entirely.

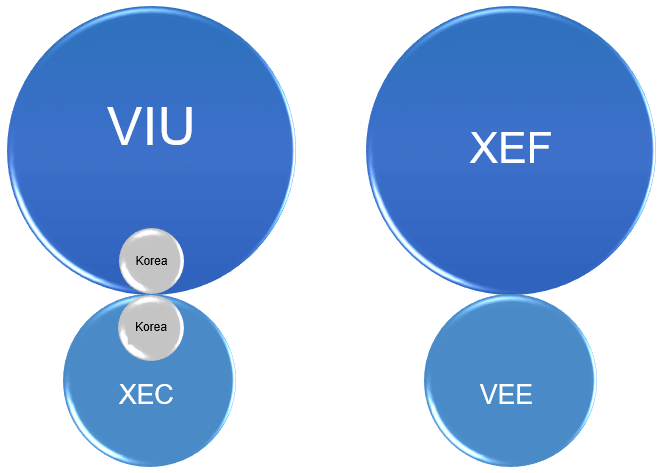

Double the Trouble: You’ll double your exposure if you combine a Vanguard developed markets equity ETF (which includes Korean stocks) with an iShares emerging markets equity ETF (which also includes Korean stocks). So, if you combine the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) with the iShares Core MSCI Emerging Markets IMI Index ETF (XEC), you receive two helpings of Korean company exposure (assuming a market cap weighting, which we’ll discuss further on).

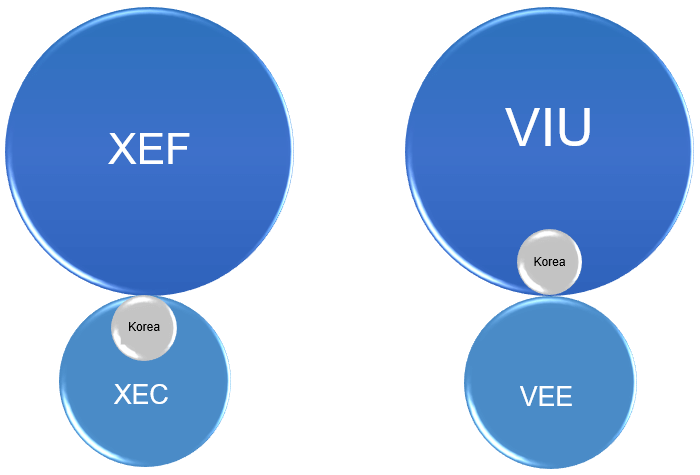

An Error of Omission: You’ll receive no exposure to Korean stocks if you combine an iShares developed markets equity ETF (which exclude Korean stocks) with a Vanguard emerging markets equity ETF (which also exclude Korean stocks). So, if you combine the iShares Core MSCI EAFE IMI Index ETF (XEF) with the Vanguard FTSE Emerging Markets All Cap Index ETF (VEE), your Korean stock exposure is a big, fat zero.

Ideally, investors seeking an appropriate allocation to Korean stocks should EITHER combine iShares international and emerging markets equity ETFs together, OR Vanguard international and emerging markets equity ETFs. So, XEF pairs with XEC, while VIU pairs with VEE. This ensures that only one of the ETFs in your combo includes Korean companies.

This seems straightforward enough. But riddle me this: What portion of your investment dollars do you allocate to each ETF? We suggest allocating your dollars based on each region’s current market cap weighting. This is how many global equity ETFs do it, including Vanguard’s asset allocation ETFs (which is a subject for another discussion, some other day).

To learn how to employ market cap weighting like a pro, let’s start with the iShares ETFs. First, google MSCI EAFE IMI Index Fact Sheet and download the most recent month-end PDF. (Ensure that the document is the U.S. dollar version.) This is the underlying index for the iShares Core MSCI EAFE IMI Index ETF (XEF).

At the top-left corner of the second page, you’ll find the market cap of the index (in USD millions). As of December 31, 2018, this amount was $14,590,688.

Follow the same process for XEC’s underlying index, the MSCI Emerging Markets IMI Index. Based on its December 31, 2018 index fact sheet, we find that its market cap in USD millions was $5,417,489.

| Tracking ETF | Underlying Index | Market Cap (in USD Millions) | Market Cap (%) | Allocation ($) |

|---|---|---|---|---|

| iShares Core MSCI EAFE IMI Index ETF (XEF) | MSCI EAFE IMI Index | $14,590,688 | 72.92% | $7,292 |

| iShares Core MSCI Emerging Markets IMI Index (XEC) | MSCI Emerging Markets IMI Index | $5,417,489 | 27.08% | $2,708 |

| Total | $20,008,177 | 100.00% | $10,000 |

Now for some math. The total combined market cap of the MSCI EAFE IMI Index and the MSCI Emerging Markets IMI Index is $20,008,177. Dividing the MSCI EAFE IMI Index $14,590,688 market cap by the $20,008,177 total combined market cap gives us 72.92%. Voila – that’s the approximate percentage to allocate to XEF. So, if you were investing $10,000 into both iShares international and emerging markets equity ETFs, you’d purchase about $7,292 of XEF ($10,000 x 72.92% = $7,292).

The rest of the $10,000, or $2,708, could go to XEC. But, if you wanted to verify that, you could do so by dividing the $5,417,489 XEC market cap by the $20,008,177 total market cap to equal 27.08% ($10,000 x 27.08% = $2,708).

We can do the same thing for Vanguard ETFs, although it has a few more steps. We’ll start by searching for the FTSE Developed All Cap Index fact sheet (in U.S. dollars). Although we are really looking for the FTSE Developed All Cap ex North America Index fact sheet, it’s not readily available. Not to worry; we can adapt this fact sheet for our purposes.

We’re looking for the country breakdown on page 2. As of December 31, 2018, the index market cap was $41,343,666 in USD millions. However, this figure includes North American companies, so we need to deduct the Canada/U.S. market caps from the total. Canada and the U.S. have a market cap of $1,369,120 and $24,755,128 in USD millions, respectively. Therefore, the market cap of the FTSE Developed All Cap ex North America Index is $15,219,418 in USD millions.

| Index | Market Cap (USD Millions) |

|---|---|

| FTSE Developed All Cap Index | $41,343,666 |

| – FTSE Canada All Cap Index | ($1,369,120) |

| – FTSE USA All Cap Index | ($24,755,128) |

| = FTSE Developed All Cap ex North America Index | $15,219,418 |

Next we’ll download the month-end fact sheet for the FTSE Emerging Markets China A Inclusion Indexes. Please note, while this fact sheet contains multiple indices, we are only interested in the market cap of the FTSE Emerging Markets All Cap China A Inclusion Index. You’ll find it in the Country Breakdown section under the appropriate index heading. As of December 31, 2018, this index’s market cap was $4,830,248 in USD millions.

| Tracking ETF | Underlying Index | Market Cap (in USD Millions) | Market Cap (%) | Allocation ($) |

| Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) | FTSE Developed All Cap ex North America Index | $15,219,418 | 75.91% | $7,591 |

| Vanguard FTSE Emerging Markets All Cap Index ETF (VEE) | FTSE Emerging Markets All Cap China A Inclusion Index | $4,830,248 | 24.09% | $2,409 |

| Total | $20,049,666 | 100.00% | $10,000 |

Now we’re back on track to compute our allocations, just as we did for the iShares ETFs. The total market cap of the FTSE Developed All Cap ex North America Index and the FTSE Emerging Markets All Cap China A Inclusion Index is $20,049,666. Dividing $15,219,418 by the $20,049,666 total market cap gives us 75.91%, which is the approximate percentage to allocate to VIU. If we were investing $10,000 into Vanguard international and emerging markets equity ETFs, we would purchase about $7,591 of VIU ($10,000 x 75.91% = $7,591).

Likewise, the remaining $2,409 balance could go to VEE … or you can verify that by dividing $4,830,248 by the $20,049,666 total market cap to arrive at 24.09% ($10,000 x 24.09% = $2,409).

So there you have it. Depending on which ETF company you choose, you can use a market cap weighting approach to achieve very similar allocations to international and emerging markets. You’ll find only modest differences between the underlying country allocations, with Korea representing a nearly identical allocation in each. Also, by pairing either Vanguard-with-Vanguard or iShares-with-iShares, you’ll be “just right” on your Korean stock exposure – neither double-dipping nor eliminating the allocation entirely due to differing definitions for the same stocks.

| Country | XEF + XEC | VIU + VEE | Difference |

| Japan | 18.4% | 18.7% | -0.3% |

| United Kingdom | 12.7% | 12.4% | +0.3% |

| China | 7.6% | 8.1% | -0.5% |

| France | 7.2% | 6.8% | +0.4% |

| Germany | 6.1% | 6.0% | +0.1% |

| Switzerland | 5.8% | 5.8% | 0.0% |

| Australia | 5.0% | 5.1% | -0.1% |

| Korea | 3.9% | 3.8% | +0.1% |

| Taiwan | 3.3% | 3.4% | -0.1% |

| India | 2.8% | 2.9% | -0.1% |

Coming up next, we’ll pop the hoods on a number of global equity ETFs that use a similar global market cap weighting scheme for their underlying country allocations.