Recently on our Canadian Portfolio Manager blog, we launched a 3-part series dedicated to helping you become an expert at managing foreign currency exposures in your ETFs. Well, if not exactly an “expert,” at least a notch or two above your typical Homer Simpson. By the way, there’s also a podcast version or a YouTube version below, if you prefer.

In Part 1, all our illustrations focused on U.S. ETFs, i.e., a single foreign stock market with only one underlying currency. Today, we’ll show you how the same concepts apply to ETFs that invest in multiple foreign stock markets, including this key concept, introduced in Part 1:

The currency in which your ETF transacts has NO RELATIONSHIP to your ETF’s currency exposure. This holds true whether the currency transaction is in Canadian or foreign denominations.

We’ll begin with an explanation from BlackRock’s Steven Leong:

“Let’s take the example of the iShares Core MSCI EAFE IMI Index ETF (XEF), which invests outside Canada and the U.S. XEF holds stocks from several other countries, such as Japan, Switzerland, Germany, the U.K., and many others. So, instead of one currency, there are multiple kinds, such as the yen, Swiss franc, euro, pound, etc.

If you own XEF, you want those currencies to go up, which would increase the value of your investment. In other words, even if XEF’s underlying stock holding prices never changed, XEF’s price would still go up or down, depending on how these foreign currencies moved against the Canadian dollar.

Also remember, foreign currencies can move in different directions. The U.S. dollar could go up against the Canadian dollar at the same time the euro goes down against the same. The direction and the size of the move is specific to each currency.

These relationships are not just theoretical. XEF handles all of its subscriptions and redemptions in Canadian dollars. But it must buy and sell foreign stocks in local currencies when transacting in foreign markets. When there’s a subscription, XEF has to settle local market transactions by selling Canadian dollars to buy yen, euros, francs, etc. If there’s a redemption, the fund must sell foreign stocks to pay for it. After receiving the foreign currency, it then sells the currency to buy Canadian dollars to pay the redemption.

So, one important advantage of using a Canadian ETF for these foreign investments is that currency conversion transactions are handled in the wholesale market by the manager, at very competitive bid-ask spreads, especially compared to what the typical brokerage would charge you to convert Canadian dollars into another currency.”

In other words, to save yourself time and energy, plus avoid getting hosed on your currency conversions, you can purchase Canadian-based foreign equity ETFs to do the currency conversions for you.

Examples include the iShares Core S&P U.S. Total Market Index ETF (XUU), the iShares Core MSCI EAFE IMI Index ETF (XEF), and the iShares Core MSCI Emerging Markets IMI Index ETF (XEC). These should save you some conversion costs compared to U.S.-based foreign equity ETFs like the iShares Core S&P Total U.S. Stock Market ETF (ITOT), the iShares Core MSCI EAFE ETF (IEFA), and the iShares Core MSCI Emerging Markets ETF (IEMG).

The overall currency concepts are very similar for U.S.-based international equity ETFs that transact in U.S. dollars. For example, consider IEFA (XEF’s counterpart). A Canadian investor would need to convert their Canadian dollars to U.S. dollars to purchase IEFA. Then, to purchase the underlying foreign stocks, BlackRock would need to convert your U.S. dollars to the various underlying currencies.

This makes IEFA’s and XEF’s foreign currency exposures similar to one another, even though they transact in different (U.S. vs. Canadian) dollars. At the risk of sounding like a broken record, it’s the ETF’s underlying foreign stock markets that determine each fund’s currency exposure – not the currency in which your ETF transacts.

For example, if XEF and IEFA each invested 27% of their assets into Japanese companies, 30% into eurozone companies and 10% into Swiss companies, Canadian investors would have a 27% exposure to the Japanese yen, 30% exposure to the euro and 10% exposure to the Swiss franc. These currency exposures would be in addition to the stock market exposures of each region. XEF would have little to no exposure to the Canadian dollar, and IEFA would have little to no exposure to the U.S. dollar (even though each transacts in these respective currencies).

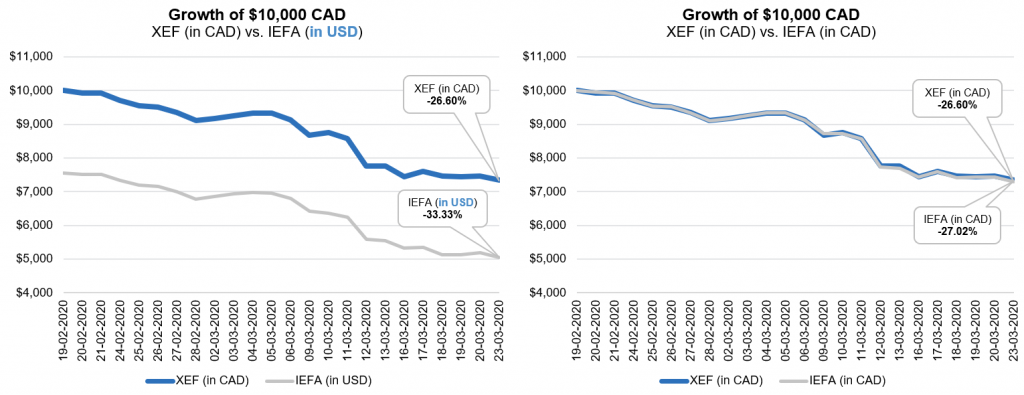

In our last post, fictional investors Bill and Ted discovered this disconnect between currency exposure versus currency transactions. We illustrated how they both came out about the same during the worst of the COVID-19 stock market crisis, even though one held XUU and the other used ITOT. Canadian investors who held XEF or IEFA during the same crisis likewise endured a similar experience, regardless of which fund they held. Between the market’s peak on February 19th and the market bottom on March 23rd, international stocks lost 31% of their value in their local currencies. Over the same period, the underlying international currencies appreciated against the Canadian dollar by around 6.1%. Again, this helped reduce the bleeding for Canadian investors.

Specifically, after accounting for currency exposure, XEF fell in value by around 27% in Canadian dollar terms. IEFA (which trades in U.S. dollars) lost around 33% of its value in U.S. dollar terms. This was due to the 3.4% depreciation of the foreign currencies relative to the U.S. dollar. However, once the U.S. dollars are converted back to Canadian dollars, IEFA returned – you guessed it – around 27% in Canadian dollar terms, which was similar to XEF.

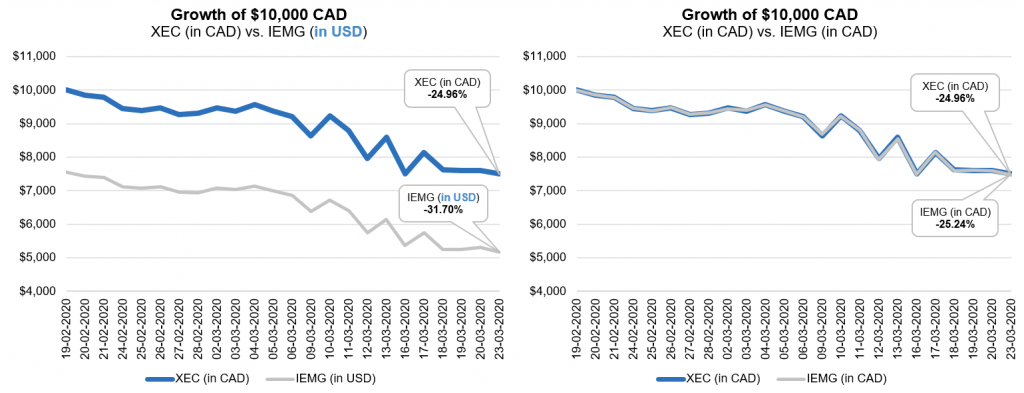

Emerging markets equity ETFs also followed a similar pattern over the same period. Emerging markets companies lost around 28% of their value in local currencies. But due to the 4.3% average appreciation of the underlying emerging markets currencies relative to the Canadian dollar, XEC lost only around 25% of its value.

Across the border, XEC’s U.S.-based counterpart, IEMG, lost nearly 32% of its value, due to the 5.1% depreciation of the underlying emerging markets currencies relative to the U.S. dollar. However, once IEMG’s U.S. dollar returns are converted back to Canadian dollars, IEMG only lost around 25% of its value, tightly tracking XEC’s performance along the way.

By now, I hope I’ve made it clear: The currency in which your ETF transacts does not determine your currency exposure. It could just as easily transact in yen, euros, or Swiss francs, and still provide you with the same investment return in Canadian dollar terms. No matter what currency you use when you purchase BlackRock’s or Vanguard’s foreign ETFs, they may need to convert your currency to other currencies to transact in foreign stock markets. This means the currency you’ve provided does not provide any useful information for determining your ETF’s underlying currency exposure.

We’ve been hitting currencies from every which way but loose in these posts. But there’s one more type of foreign equity ETF I’d like to touch on. Next up, we’ll talk about the “dot-U” ETFs.