In our last episode, we learned how to combine international and emerging markets equity ETFs in a madcap, market cap global adventure (by way of Korea). If the entire exercise brought back unpleasant memories of elementary school math drills, you might prefer our next three pieces. In them, we’ll review six global equity ETFs that still allow you to invest globally, but eliminate the need to calculate market-cap weightings along the way. We’ll take them two at a time:

Our first ETF on today’s tour is the iShares MSCI World Index ETF (XWD). It was released in 2009 and trades on the Canadian stock market. It was a favourite among Couch Potato investors, until cheaper and more tax-efficient options came along.

As its name suggests, XWD follows the MSCI World Index. But it’s not quite as worldly as you might think. First, it only tracks companies in developed, not emerging markets. And, since “IMI” (Investable Market Index) is missing from the name, we also know it tracks only large- and mid-cap companies; it excludes small-caps.

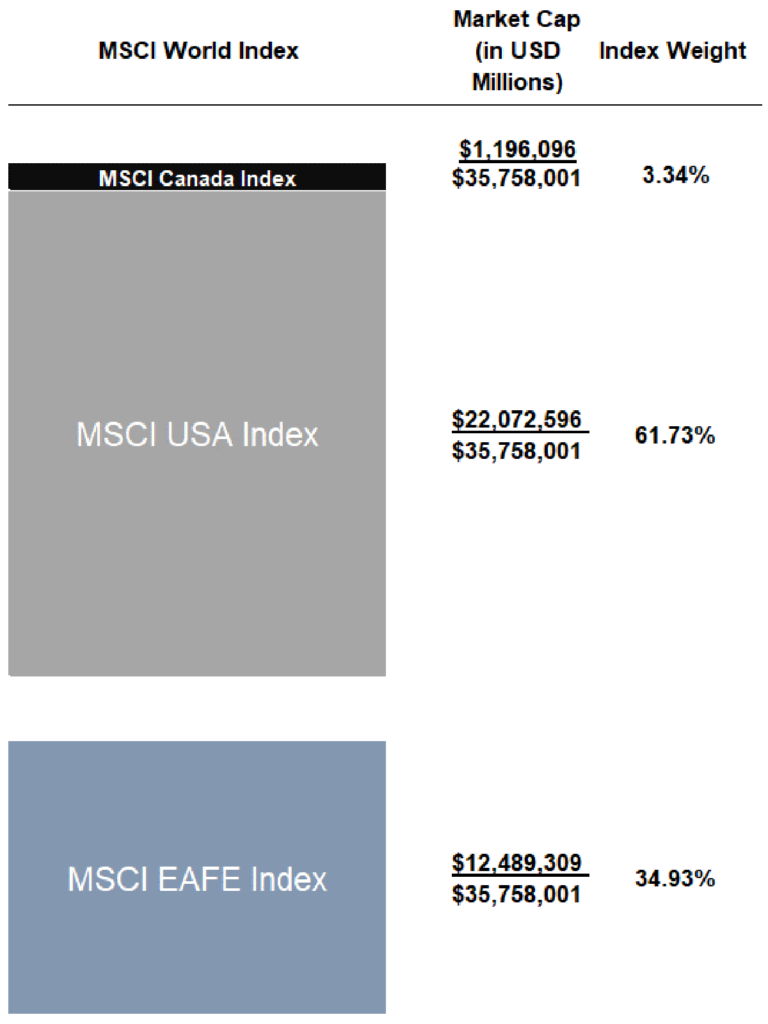

Basically, you can think of the MSCI World Index as the MSCI Canada Index + MSCI USA Index + MSCI EAFE Index, in the following proportions:

Do you still want to calculate market-cap weights (even though the XWD fund has done the math for you)? You can determine the weights of each region by dividing the market cap of each index (taken from the MSCI index fact sheets) by the total market cap of the MSCI World Index. For a step-by-step guide, please refer to my last piece, Combining International and Emerging Markets Equity ETFs.

By doing this, we find that Canadian stocks are 3.34% of the MSCI World Index, and U.S. and international stocks are 61.73% and 34.93%, respectively, as of December 31, 2018.

To gain exposure to these developed markets, XWD uses a “fund-of-funds” approach, meaning it holds existing ETFs, instead of purchasing the underlying stocks directly.

But, there’s a wrinkle: There are no iShares ETFs that track the MSCI Canada or MSCI USA indexes. Instead, iShares substituted similar ETFs from its product line-up:

Similar, yes. But the indices XIU and IVV track exclude many of the mid-cap companies that are included in the MSCI Canada and MSCI USA indexes.

A perfectionist may quibble, but excluding Canadian and U.S. mid-cap stocks hasn’t hurt XWD’s performance – at least not yet. Since July 2009 (near XWD’s inception date), S&P/TSX 60 Index returns have been slightly better than MSCI Canada Index returns, and the S&P 500 Index returns have been nearly identical to the MSCI USA Index returns:

| Index | Annualized Returns Since July 2009 |

| S&P/TSX 60 Index | 6.40% |

| MSCI Canada Index | 6.04% |

| S&P 500 Index | 15.41% |

| MSCI USA Index | 15.38% |

For XWD’s international exposure, the fund holds the iShares MSCI EAFE ETF (EFA), chosen because it follows the correct MSCI EAFE Index.

If you wanted to replicate XWD’s exposure without investing in it, you could instead purchase the three underlying ETFs directly in similar weights. Your portfolio’s complexity would increase, but in exchange, your MER would decrease – from 0.47% for XWD to about 0.14% for the ETF trio.

By holding the underlying U.S.-listed international and U.S. equity ETFs directly, you’d also reduce foreign withholding taxes in your tax-deferred accounts. Surprised? Remember, if a Canadian-listed ETF holds U.S.-listed foreign equity ETFs, the 15% U.S. withholding taxes on foreign dividends still applies. But as an individual investor, you can avoid this tax drag by purchasing IVV and EFA directly in your tax-deferred account.

Even with potential tax savings and cost benefits, you may not want the hassle of holding three funds, when one might do. Enter the iShares MSCI World ETF (with the clever ticker symbol, ‘URTH’). URTH gives you exposure to the MSCI World Index, lets you reduce costs and foreign withholding taxes, and is a single fund. It trades on the U.S. stock market in U.S. dollars, and its 0.24% cost is nearly half of XWD’s 0.47% MER.

When URTH is held in a tax-deferred account (such as an RRSP, LIRA, RRIF or LIF), the 15% U.S. foreign withholding tax on dividends does not apply, which saves you an additional 0.33% per year, relative to XWD. So, by holding URTH instead of XWD in your RRSP, you could potentially save a total of 0.56% per year in product costs and foreign withholding taxes.

| Account Type | XWD | URTH |

| Registered Retirement Savings Plan (RRSP)

Registered Retirement Income Fund (RRIF) Locked-in Retirement Account (LIRA) Locked-in Income Fund (LIF) |

0.46% | 0.13% |

| Tax-Free Savings Account (TFSA)

|

0.46% | 0.47% |

| Registered Education Savings Plan (RESP)

|

0.46% | 0.47% |

| Registered Disability Savings Plan (RDSP)

|

0.46% | 0.47% |

| Taxable Accounts

|

0.10% | 0.13% |

We’re up and running in our (mostly) math-free global market tour. Next up, we’ll take a look at two more global equity ETFs that include emerging markets.