In my last blog post, we found that overweighting Canadian stocks by about 30% (relative to a global market capitalization equity weight of about 3%) had historically resulted in a less risky portfolio. Obviously, this analysis gave no guarantee of the minimum risk portfolio going forward, but it did provide a useful starting point for discussion.

This week, we received our first email from an investor who wanted to know why our model ETF portfolios didn’t have a higher allocation to Canadian stocks. As Canadian stocks have outperformed global stocks by a wide margin during 2016, we figured that it was only a matter of time before investors started to favour Canadian stocks once again.

This brings me to my next argument for overweighting Canadian stocks:

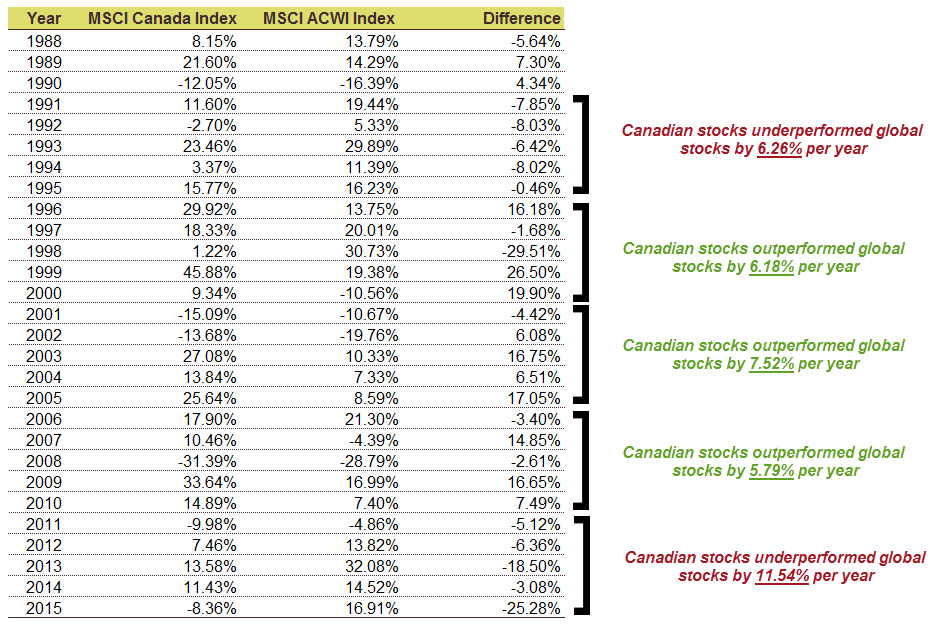

This is one of the most important, but often most underappreciated aspects of the global equity mix decision. Over the past five calendar years, global stocks have outperformed Canadian stocks by an impressive 11.54% per year. Recency bias (the tendency to base our investing decisions on more recent events) has caused investors to question why on earth they would have any portion of their portfolio invested in Canadian stocks (or even more recently, why they don’t have more invested in Canadian stocks).

Global stocks have not always been the investor darlings that they were at the end of 2015. If we look at the fifteen calendar years prior to 2011, we find that Canadian stocks outperformed global stocks by an average of 6.52% per year. During that time, it was not uncommon for Canadian investors to dismiss global stocks entirely and instead opt for a 100% allocation to Canadian stocks.

Between 1996 and 2010 (the same fifteen year period), a $100,000 investment in Canadian stocks would have grown to $453,510. During the same period, a $100,000 investment in global stocks would have grown to only $182,207 (for a difference of $271,303). Most Canadian investors that chose a market capitalization-weighted portfolio (with only about a 3% weighting in Canadian stocks) would have been kicking themselves for their decision. This would have been especially true if they knew how their friends and family had been invested.

Using 2014 year-end data from the International Monetary Fund’s Coordinated Portfolio Investment Survey and the World Federation of Exchanges, Morningstar estimated the average Canadian equity content of a Canadian investor to be around 62% (Vanguard Canada estimated this figure to be around 59% at the end of 2012). If the average Canadian investor had a similar home-bias to these figures between 1996 and 2010, it would have made the cocktail discussions even more intolerable for a market capitalization-weighted investor.

Sure, maybe the returns of Canadian stocks will soon fall short of their global counterparts once again. But what if they continue to outperform over the next five, ten, or even fifteen years?

Fifteen years is a long time to be consistently wrong. Investors need to choose an asset mix that they can stick to through the good times and bad. Personally, I’m comfortable with overweighting Canadian stocks by 30%, but I would never argue with an investor who allocated 50% of their stock allocation to Canadian stocks and 50% to global stocks, for behaviour reasons.