Last week we looked at the iShares Edge MSCI Multifactor Canada Index ETF (XFC), one of a trio of new ETFs based on multifactor indexes from MSCI. Recall that we found a few surprises in our analysis: a large part of the index’s performance could not be explained by the size, value, momentum and quality factors. Now let’s see how the US and international multifactor indexes hold up to the same analysis.

My first issue with the iShares Edge MSCI Multifactor USA Index ETF (XFS) is that its underlying index doesn’t use a broad-market parent index (like the MSCI USA IMI Index). Instead, its universe is the MSCI USA Index, which excludes small cap companies. A multifactor ETF that tilts towards small companies is going to have a hard time doing so when their parent index contains only large and mid cap companies. iShares argues that mid cap companies have also historically outperformed large cap companies in the US, so we’ll leave it at that.

The management fees on this product are 0.45%, making it 6-7 times more expensive than the broad market iShares Core S&P U.S. Total Market Index ETF (XUU). XUU also tracks an index that includes 3,817 stocks, while XFS tracks an index of only 135 stocks.

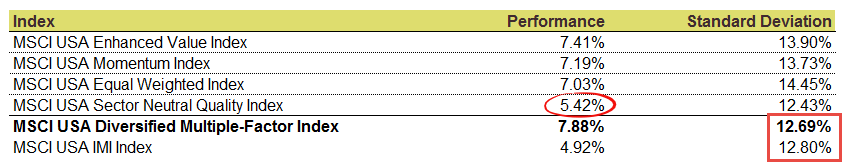

The tracking error of the MSCI USA Diversified Multiple-Factor Index has been lower than most of the other single factor indices, so this should also help investors with their behavioural biases.

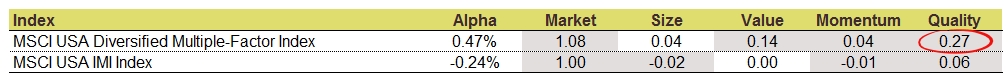

A 5-factor regression analysis of the multiple-factor index reveals an unexplained alpha of 0.47%, though this is nowhere near as troubling as it was in our Canadian example. Although the index did not have a heavy size or momentum tilt, it did include a healthy dose of value (+0.14) and quality (+0.27), as we should expect.

While the regression analysis showed few surprises, I do find it odd that none of the individual factor indices outperformed the multiple-factor index over the measurement period. As you can see in the table below, the individual factor indexes had annualized returns no higher than 7.41%. Yet somehow the multi-factor index returned 7.88%. This could be due to a rebalancing bonus of some kind, but the amount just seems high. (Imagine a portfolio of ETFs that earned a higher return than every one of its individual holdings.) Also, the largest tilt in the multiple-factor index was to the quality factor, and yet this was the worst performing individual factor index of the group, at 5.42%.

Similar to XFS, the iShares Edge MSCI Multifactor EAFE Index ETF (XFI) sorts its stocks from an index that excludes small cap companies.

The management fees on XFI are also 0.45%, which is roughly double the cost of the broad-market iShares Core MSCI EAFE IMI Index ETF (XEF). XEF also tracks an index of 3,164 stocks, while XFI includes just 209 companies.

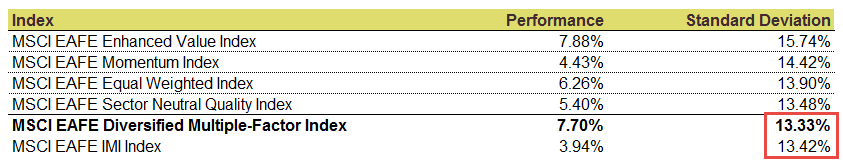

The tracking error of the MSCI EAFE Diversified Multiple-Factor Index relative to the broad-market index is the lowest of the three multiple-factor indices, at 1.15%. It is also lower than any of the individual MSCI factor indices listed below. This should lead to fewer cases of regret among investors who have become accustomed to plain-vanilla indexing.

![]()

![]()

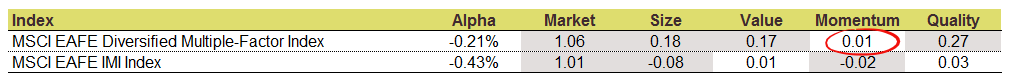

The 5-factor regression showed a significant tilt towards all factors except momentum. Nothing else in the results really jumped out as being out of place:

If you’ve made it this far, you’ve probably already made the decision to stick with your low-cost, plain-vanilla indexing strategy. Factor investing is enticing, but as we’ve seen with these multifactor indexes, it can be difficult to put into practice. If you use a factor-based ETF that claims to capture the premiums from value or momentum stocks, for example, it’s hard to know whether you’re getting what you’ve been promised. Do you really want to be running 5-factor regressions as part of your due diligence process?

These strategies also have more turnover than a passive strategy (MSCI estimates their global multiple-factor portfolio turnover at 40.1%, relative to 3.1% for their global passive index strategy). In taxable accounts, this increased turnover could result in higher capital gains distributions and lower after-tax returns. I still recommend choosing a strategy that you are comfortable with and that is easy to understand.