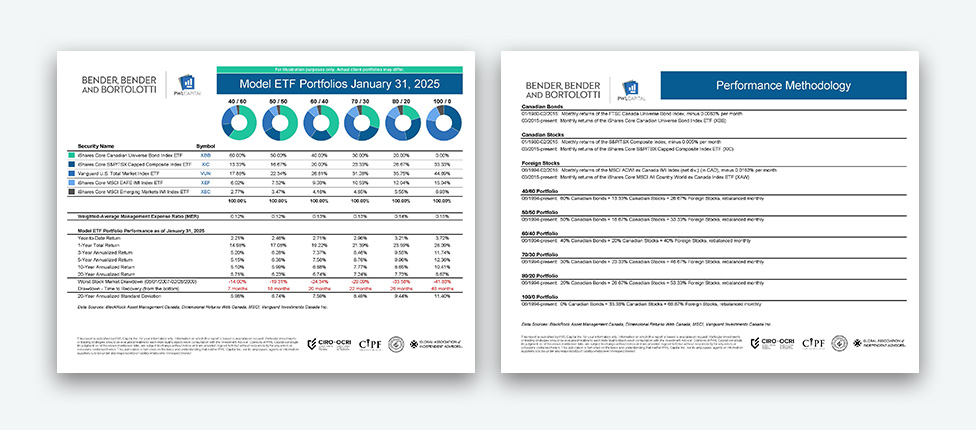

Model Portfolios - Interactive View

For illustration purposes only. Actual client portfolios may be different.

| Year-to-Date Return | 2.21% |

| 1-Year Total Return | 14.98% |

| 3-Year Annualized Return | 5.20% |

| 5-Year Annualized Return | 5.15% |

| 10-Year Annualized Return | 5.10% |

| 20-Year Annualized Return | 5.71% |

| Worst Stock Market Drawdown (06/01/2007-02/28/2009) | -14.00% |

| Drawdown - Time to Recovery (from the bottom) | 7 months |

| 20-Year Annualized Standard Deviation | 5.98% |

40/60

Funds Holdings

|

iShares Core Canadian Universe Bond Index ETF

|

60.00% |

|

iShares Core S&P/TSX Capped Composite Index ETF

|

13.33% |

|

Vanguard U.S. Total Market Index ETF

|

17.88% |

|

iShares Core MSCI EAFE IMI Index ETF

|

6.02% |

|

iShares Core MSCI Emerging Markets IMI Index ETF

|

2.77% |

| Year-to-Date Return | 2.46% |

| 1-Year Total Return | 17.08% |

| 3-Year Annualized Return | 6.28% |

| 5-Year Annualized Return | 6.36% |

| 10-Year Annualized Return | 5.99% |

| 20-Year Annualized Return | 6.23% |

| Worst Stock Market Drawdown (06/01/2007-02/28/2009) | -19.31% |

| Drawdown - Time to Recovery (from the bottom) | 18 months |

| 20-Year Annualized Standard Deviation | 6.74% |

50/50

Funds Holdings

|

iShares Core Canadian Universe Bond Index ETF

|

50.00% |

|

iShares Core S&P/TSX Capped Composite Index ETF

|

16.67% |

|

Vanguard U.S. Total Market Index ETF

|

22.34% |

|

iShares Core MSCI EAFE IMI Index ETF

|

7.52% |

|

iShares Core MSCI Emerging Markets IMI Index ETF

|

3.47% |

| Year-to-Date Return | 2.71% |

| 1-Year Total Return | 19.22% |

| 3-Year Annualized Return | 7.37% |

| 5-Year Annualized Return | 7.56% |

| 10-Year Annualized Return | 6.88% |

| 20-Year Annualized Return | 6.74% |

| Worst Stock Market Drawdown (06/01/2007-02/28/2009) | -24.34% |

| Drawdown - Time to Recovery (from the bottom) | 20 months |

| 20-Year Annualized Standard Deviation | 7.59% |

60/40

Funds Holdings

|

iShares Core Canadian Universe Bond Index ETF

|

40.00% |

|

iShares Core S&P/TSX Capped Composite Index ETF

|

20.00% |

|

Vanguard U.S. Total Market Index ETF

|

26.81% |

|

iShares Core MSCI EAFE IMI Index ETF

|

9.03% |

|

iShares Core MSCI Emerging Markets IMI Index ETF

|

4.16% |

| Model Portfolio Performance | 70/30 |

|---|---|

| Year-to-Date Return | 2.96% |

| 1-Year Total Return | 21.39% |

| 3-Year Annualized Return | 8.46% |

| 5-Year Annualized Return | 8.76% |

| 10-Year Annualized Return | 7.77% |

| 20-Year Annualized Return | 7.24% |

| Worst Stock Market Drawdown (06/01/2007-02/28/2009) | -29.09% |

| Drawdown - Time to Recovery (from the bottom) | 22 months |

| 20-Year Annualized Standard Deviation | 8.49% |

70/30

Funds Holdings

|

iShares Core Canadian Universe Bond Index ETF

|

30.00% |

|

iShares Core S&P/TSX Capped Composite Index ETF

|

23.33% |

|

Vanguard U.S. Total Market Index ETF

|

31.28% |

|

iShares Core MSCI EAFE IMI Index ETF

|

10.53% |

|

iShares Core MSCI Emerging Markets IMI Index ETF

|

4.85% |

| Model Portfolio Performance | 80/20 |

|---|---|

| Year-to-Date Return | 3.21% |

| 1-Year Total Return | 23.59% |

| 3-Year Annualized Return | 9.55% |

| 5-Year Annualized Return | 9.96% |

| 10-Year Annualized Return | 8.65% |

| 20-Year Annualized Return | 7.73% |

| Worst Stock Market Drawdown (06/01/2007-02/28/2009) | -33.58% |

| Drawdown - Time to Recovery (from the bottom) | 26 months |

| 20-Year Annualized Standard Deviation | 9.44% |

80/20

Funds Holdings

|

iShares Core Canadian Universe Bond Index ETF

|

20.00% |

|

iShares Core S&P/TSX Capped Composite Index ETF

|

26.67% |

|

Vanguard U.S. Total Market Index ETF

|

35.75% |

|

iShares Core MSCI EAFE IMI Index ETF

|

12.04% |

|

iShares Core MSCI Emerging Markets IMI Index ETF

|

5.55% |

| Model Portfolio Performance | 100/0 |

|---|---|

| Year-to-Date Return | 3.72% |

| 1-Year Total Return | 28.09% |

| 3-Year Annualized Return | 11.74% |

| 5-Year Annualized Return | 12.36% |

| 10-Year Annualized Return | 10.41% |

| 20-Year Annualized Return | 8.67% |

| Worst Stock Market Drawdown (06/01/2007-02/28/2009) | -41.83% |

| Drawdown - Time to Recovery (from the bottom) | 48 months |

| 20-Year Annualized Standard Deviation | 11.40% |

100/0

Funds Holdings

|

iShares Core Canadian Universe Bond Index ETF

|

0.00% |

|

iShares Core S&P/TSX Capped Composite Index ETF

|

33.33% |

|

Vanguard U.S. Total Market Index ETF

|

44.69% |

|

iShares Core MSCI EAFE IMI Index ETF

|

15.04% |

|

iShares Core MSCI Emerging Markets IMI Index ETF

|

6.93% |