In 2020, all you had to do to earn decent returns was stay invested. It didn’t really matter what asset classes you were invested in. Both stock and bond markets performed well, so even conservative investors with a bond-heavy portfolio weren’t complaining.

2021 was a bit different. All-equity portfolios returned around 20%, while conservative investors got the short end of the return stick. Safer bonds were a drag on returns, but investors with a balanced mix of stocks and bonds still saw double-digit returns in 2021.

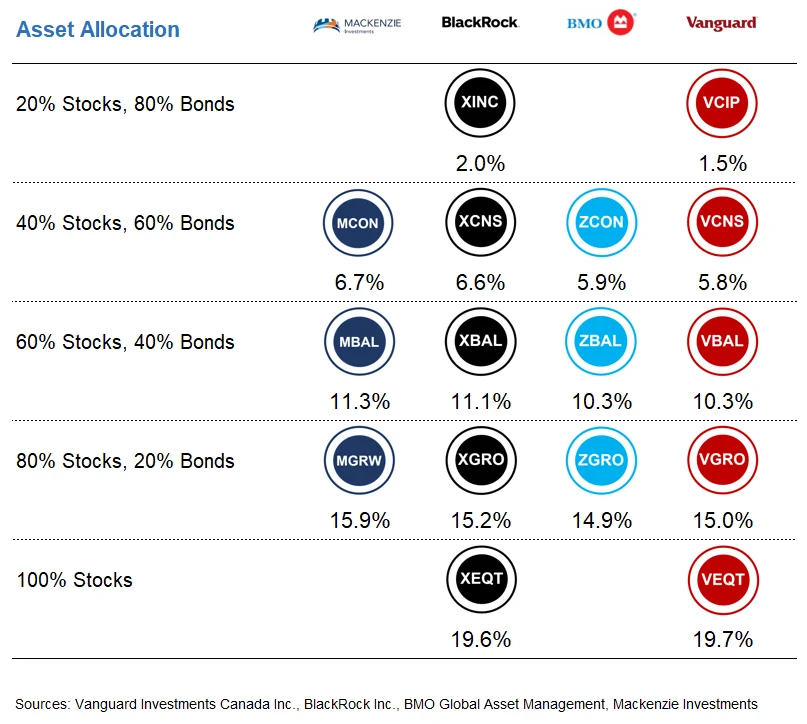

In this post, we’ll review 2021 performance for Vanguard, iShares, BMO, and Mackenzie asset allocation ETFs, as well as for their underlying holdings.

If you’d like to skip straight to the compelling conclusion, you could have thrown a dart at these asset allocation ETF providers, and come out about the same. As usual, the takeaway is as follows: First have a sturdy investment plan to guide your investment allocations to begin with. Then look for a fund provider that lets you implement your plan cleanly and cost-effectively. After that, you may find it interesting to compare the annual nuances between appropriate providers, but it’s largely an optional, if not detrimental exercise.

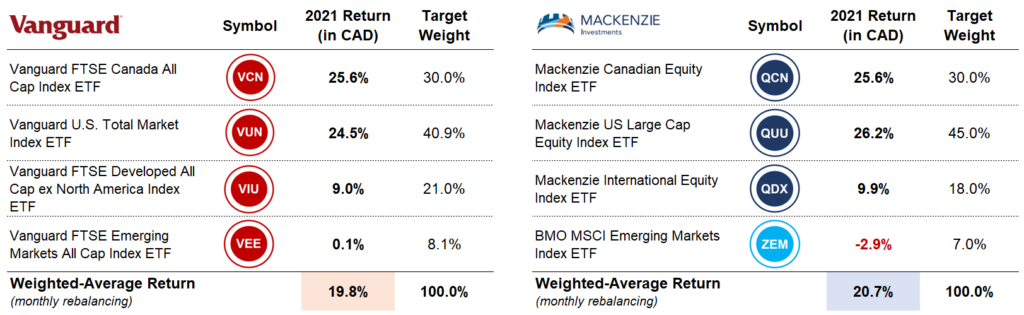

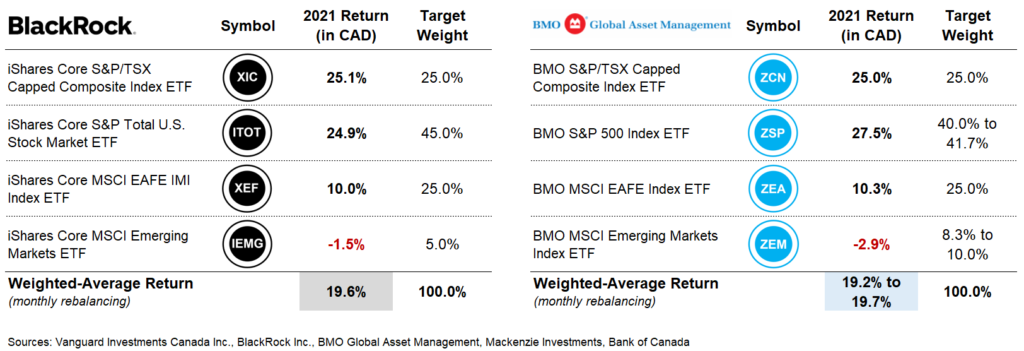

Before we look at 2021 returns for the asset allocation ETFs, let’s check out the year-end results for their underlying holdings, starting with the equity ETFs in our Canadian Portfolio Manager model portfolios.

While Canadian equities performed adequately in 2020, they really outdid themselves in 2021, returning a net of around 25% across all portfolios. That was enough to squeak past the net returns in Canadian dollars for the broad U.S. stock market ETFs.

U.S. equities also ended 2021 on a high note. The U.S. equity ETFs in our model portfolios returned between 24.5%–27.5% in Canadian dollars, net of withholding tax. The BMO and Mackenzie ETFs had slightly higher U.S. equity returns, due to the large-cap bias in their funds. It’s interesting to note that BMO decided to include a small allocation to mid- and small-cap U.S. equities in 2021, so we may see their large-cap bias diminish over time.

International developed equities ended the year on a positive note as well, with net returns between 9.0%–10.3%. We can largely explain the return differences across issuers based on whether or not they included South Korean companies, which returned –6.5% in Canadian dollars in 2021.

This explains the lower relative performance for the Vanguard FTSE Developed All Cap ex North America Index ETF fund (VIU), which tracks a FTSE index that includes Korea as a developed country. In contrast, the iShares Core MSCI EAFE IMI Index ETF (XEF), BMO MSCI EAFE Index ETF (ZEA), and Mackenzie International Equity Index ETF (QDX) follow developed markets indexes that exclude Korea, classifying the country as an emerging market instead.

Compared to developed markets, emerging markets equities were a disappointment in 2021, with returns ranging from +0.1% to –2.9%. This time, VEE had the slight return advantage, due to the exclusion of the underperforming Korean companies in their emerging markets fund.

All together now: If we combine these equity asset classes according to their target asset allocation ETF weights (rebalancing monthly and adjusting for additional asset allocation ETFs fees), we find their overall equity returns are similar across the board. Mackenzie did manage to slightly outperform the others, with estimated equity returns of 20.7%. This outperformance was mainly due to Mackenzie’s higher allocation to Canadian and U.S. equities, which were the top-performing equity regions in 2021.

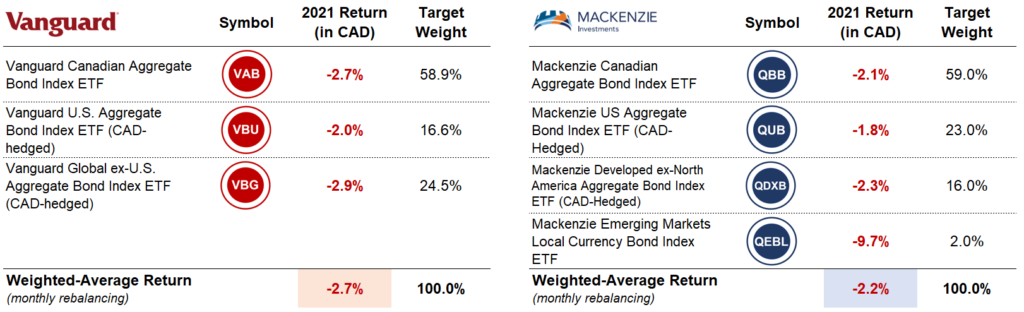

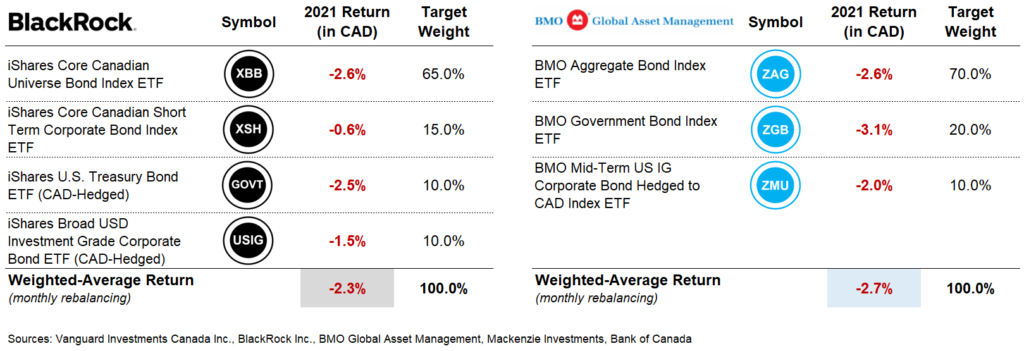

Next, let’s check out fixed income returns, since your asset allocation ETF portfolio likely holds some bonds too.

The weighted average yield to maturity of Canadian bond ETFs started the year at 1.2%, but had increased to around 1.9% by year-end. Remember, an increase in yield decreases bond prices, so this resulted in modest losses across all fixed income securities included in our model portfolios.

Broad market Canadian bond ETFs returned between –2.1% and –2.7% in 2021, with Canadian government bonds performing even worse, at –3.1%.

Currency-hedged foreign bonds performed similarly to their Canadian counterparts, with returns ranging from –1.5% to –2.9%.

Local currency emerging markets bonds weren’t even that lucky in 2021, with nearly double-digit losses of –9.7%. Fortunately, this asset class only makes up a small portion of the Mackenzie Asset Allocation ETFs, so it had little impact on their total performance.

Short-term Canadian corporate bonds, which make up 15% of the fixed income allocation of the iShares portfolios, fared slightly better, with a 2021 return of –0.6%. Their inclusion helped reduce the iShares portfolios’ fixed income losses in 2021.

To estimate a ballpark return for each portfolio’s fixed income allocation, we can once again take the weighted average of each ETF’s return and rebalance monthly, adjusting for the additional fees charged on the asset allocation ETFs. Doing so provides us with an estimated –2.7% for the Vanguard and BMO portfolios, –2.3% for the iShares portfolios, and –2.2% for the Mackenzie portfolios.

Again, it didn’t much matter which asset allocation ETF provider you invested with in 2021. For any given risk level, their returns were within 1% of one another. Since our estimates gave Mackenzie the edge in both equity and fixed income portfolios, it’s no surprise they outperformed the others across their conservative, balanced, and growth allocations. Because iShares portfolios included better-performing short-term Canadian corporate bonds, they landed in second place at every risk level, except (unsurprisingly) the all-equity group.

Here’s a visual overview for the year:

As we suggested at the outset, don’t read too much into these short-term variations. Mackenzie may have gained the edge over the others in 2021, but that does not foretell what to expect going forward. Over the long-term, we would continue to expect similar returns for comparable asset mixes, so why mess with it? In the wise words of financial legend Charles Ellis:

“Benign neglect is the secret to long-term investing success. If you change your investment policy, you are likely to be wrong; if you change it with a sense of urgency, you’re guaranteed to be wrong.”

— Charles Ellis, in “Wall Street’s Wisest Man”

Besides, leaving your portfolio alone gives you more time to watch for our latest Canadian Portfolio Manager insights throughout 2022 and beyond. Happy New Year!