Since their release, the Vanguard and iShares asset allocation ETFs have taken the investing world by storm, with assets under management now in the billions of dollars. The funds have also become the go-to recommendation within the DIY investing community, and for good reason. With the click of a mouse, Canadian investors can purchase a globally diversified portfolio of stocks and bonds, at a fraction of the cost charged by most actively managed mutual funds.

But before clicking the buy button, it’s important to understand what you’re actually investing in. In this next series of videos, we’re going to pop the hood on these portfolios to check-out their individual components.

In this blog/video, we’ll be discussing Vanguard and iShares’ respective broad-market Canadian equity ETFs, which include:

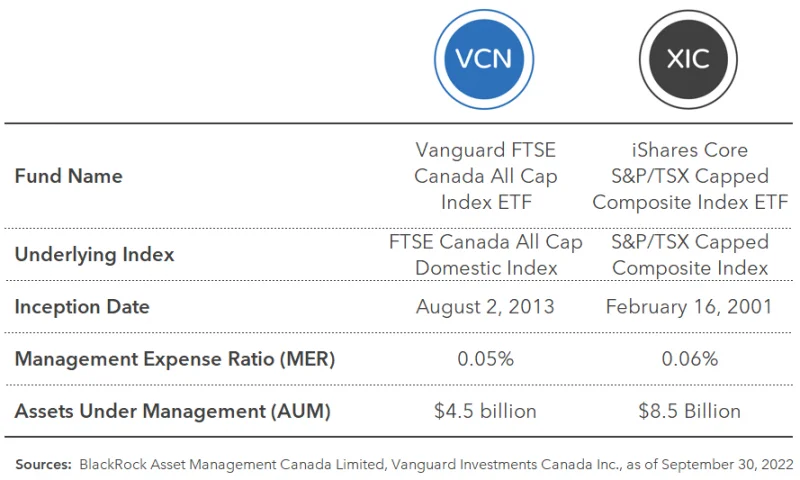

Both ETFs already have a long-term track record. XIC launched in 2001, while VCN made its debut several years later, in 2013.

In terms of cost, the management expense ratios (or MERs) for each of these ETFs are also extremely low. On a $10,000 investment, the total annual cost would be around the same as a specialty Starbucks latte.

With such low fees, it’s no surprise these ETFs have accumulated billions of dollars in assets. And due to their popularity, it’s unlikely either of them will close-up shop anytime soon.

Next, let’s cover fund construction. I’m going to show you that the funds do differ slightly from one another in terms of which index they track, and how they weight their holdings. But practically speaking, it probably doesn’t matter which one you prefer. They’re both great choices for your investment portfolio.

With respect to index tracking, XIC tracks the S&P/TSX Capped Composite Index. This index covers approximately 95% of the Canadian stock market, and includes large, mid and small-sized companies. The word “Capped” in the name indicates that an individual company’s weight cannot increase beyond 10% of the total index. If it does, its weight will be capped at 10%. Without this feature, a single company can take over the index, like Nortel did in 2000 when it grew to more than a third of the uncapped S&P/TSX Composite Index.

VCN follows the FTSE Canada All Cap Domestic Index. Not to be confused with the “Capped” term I just mentioned, the “All Cap” in its name means this FTSE index tracks the performance of large-, mid-, and small-cap stocks. And unlike the S&P/TSX Capped Composite Index, VCN’s index does not constrain any company weightings. This means any company is free to exceed 10% of the index value.

The weight for each company in a broad market Canadian equity index is determined by taking the dollar value of each company’s outstanding shares available to regular investors and dividing it by the total value of most companies in the Canadian stock market. This process is called “market-capitalization weighting”, or “market-cap weighting” – again, not to be confused with the “capped” and “all cap” terms from earlier.

For example, an index provider would start by adding up all the company values in their eligible broad market universe to determine the total index value. They would then divide each individual company’s worth by the total index value, providing them with a percentage weighting for each company. An ETF tracking this broad market index would then purchase shares in each company’s stock in similar proportions.

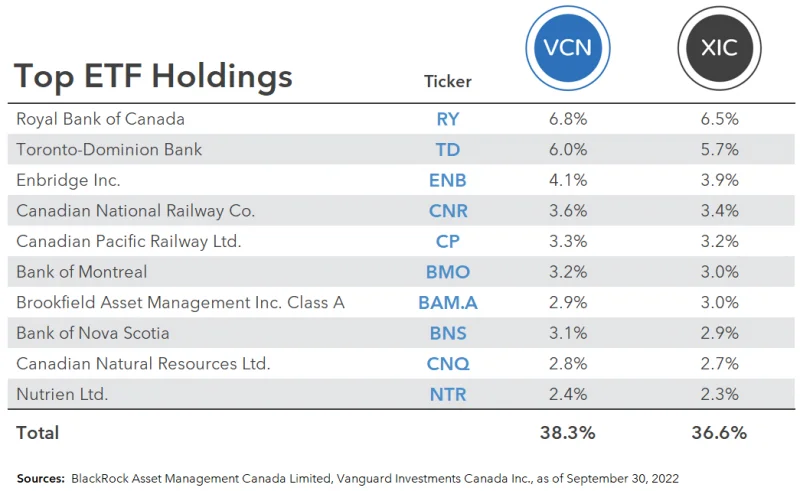

In effect, a market-cap weighted index leads to larger companies dominating the index, leaving very little room for smaller companies. So, as expected, the top holdings in our two ETFs are all larger companies that make up a significant portion of each fund.

Although most broad Canadian stock market indexes are very similar, their holdings will differ slightly from one another, and so will the holdings of the ETFs tracking them. However, in most cases, these differences are minor and are expected to have little impact on the long-term relative performance of each ETF.

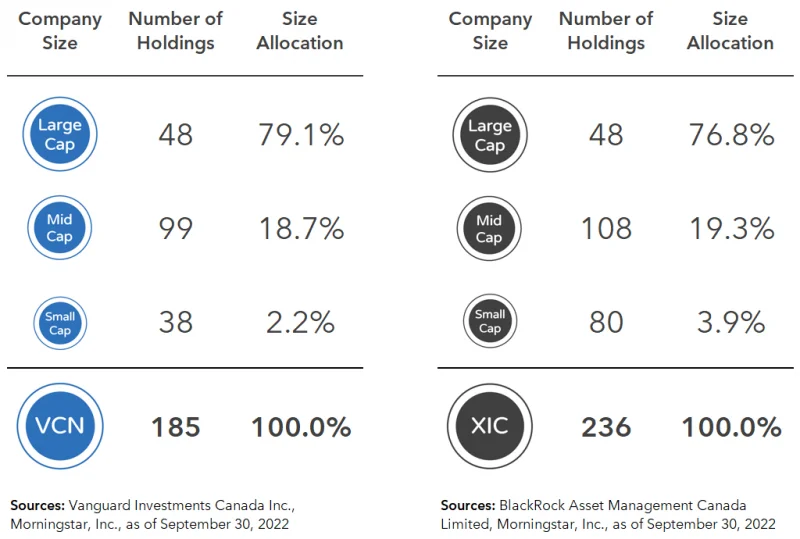

Both ETFs include hundreds of Canadian companies, with XIC including slightly more companies than VCN. This may seem like an important difference. But because the market-cap weighted indexes they follow place more emphasis on larger companies, it’s these larger company returns that drive most of the ETF’s performance.

For example, if we review each fund’s allocation between large, mid, and small-cap companies, we find they are all heavily biased towards large-cap and mid-cap companies, with only a small percentage allocated to smaller companies. Once again, this is expected with a market-cap weighted index strategy.

In other words, even though XIC includes more small-cap stocks, these companies are given minimal weight within the fund, so their inclusion is expected to have little impact on the ETF’s overall return.

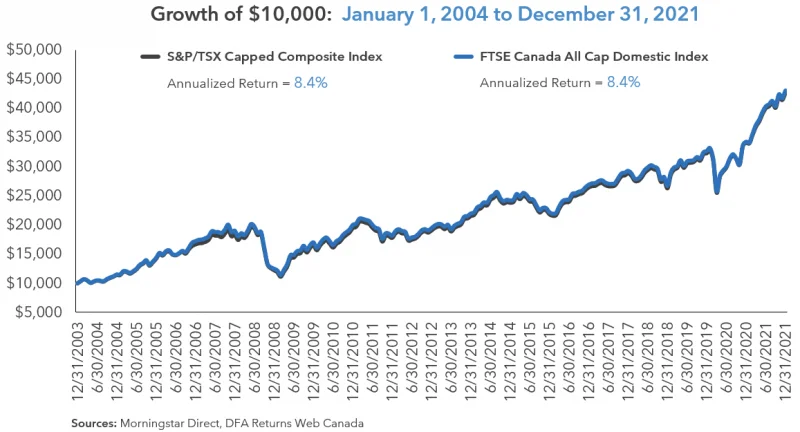

So overall, the broad market indexes tracked by our Canadian equity ETFs are substantially similar to one another. As such, we would expect their performance to be similar as well. Sure enough, if we compare the growth of $10,000 invested in each index since 2004, we find nearly identical performance for both.

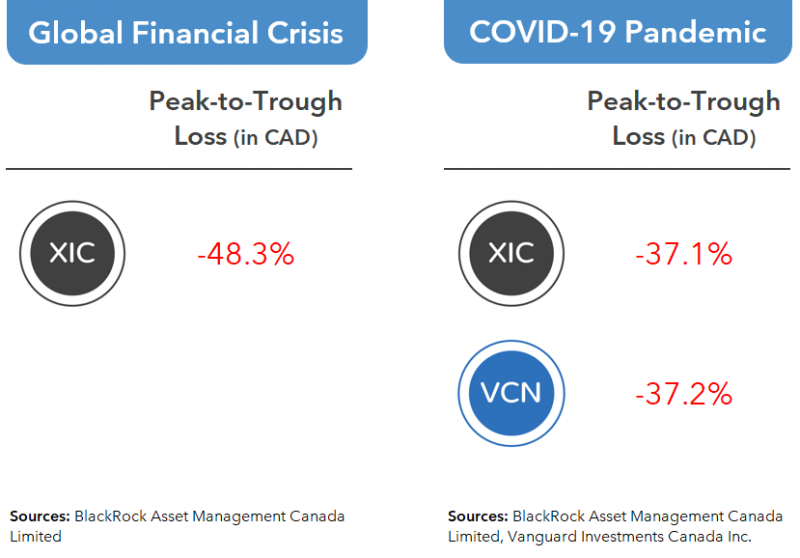

In terms of risk, both ETFs have experienced losses of around 30-50% at some point. For example, during the Global Financial Crisis, XIC lost nearly half of its value. And during the worst of the COVID-19 pandemic, both ETFs lost around 37% of their value. Going forward, you should expect similar drawdowns on your Canadian equity ETFs throughout your investing lifetime.

Once you’ve built up the necessary investing fortitude, don’t stress yourself trying to choose the perfect Canadian equity ETF. None of them can confidently make that claim, but either of the ones we’ve discussed today would be an excellent core holding in your portfolio. If you like the 10% capping feature, go with XIC. If you want less smaller companies in your portfolio, opt for VCN. If you don’t care, flip a coin to decide.

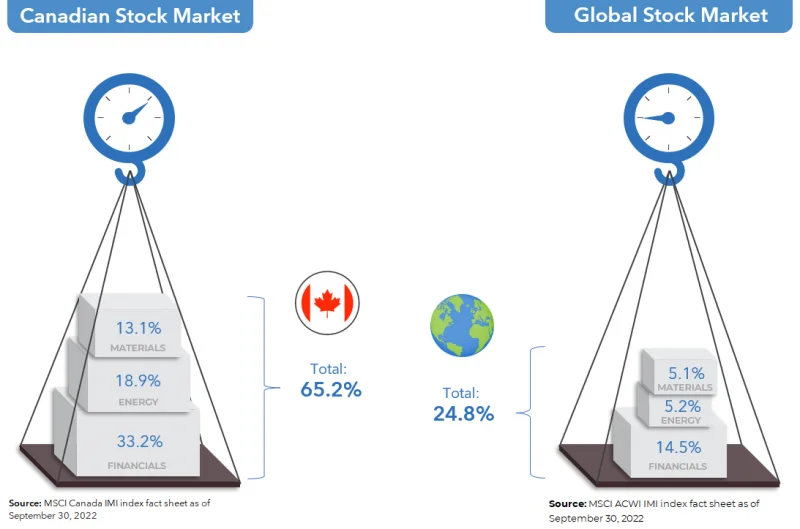

One more point before we wrap up this video. It’s well known that the Canadian stock market is poorly diversified, which means Canadian equity ETFs tracking the broad Canadian stock market are poorly diversified as well. The majority of the Canadian stock market is concentrated in the financial, energy, and materials sectors. This is a significant overweight, at least relative to the sector weightings of the global stock market.

But not to worry. Once you further diversify your portfolio into ETFs that invest in foreign companies, you’ll water down this sector concentration risk. More on that in our future blogs/videos!