I recently received this next question from a blog reader, but I’ve been asked the same thing countless times over the past five years. This is not surprising, since foreign stocks have outperformed Canadian stocks by over 6% each year for the past little while.

Jean-Francois: Why does Vanguard have a 30% weighting to Canadian stocks in its asset allocation ETFs, even though Canadian companies make up only around 3% of the global stock market?

Bender: Thanks for your question, Jean-Francois. In financial lingo, this overweighting is known as a “home bias.” I’m certain other investors have also wondered about the overweight to Canadian stocks in most asset allocation ETFs, as well as in the Canadian Portfolio Manager and Canadian Couch Potato model ETF portfolios.

First of all, no one knows the optimal future mix between Canadian and foreign stocks. I don’t know, nor does Vanguard, BMO, or iShares. Also, a comfortable split for one investor may cause another to abandon their investment plan when things get bumpy, so there’s no one right allocation for everyone.

Let’s review five reasons why overweighting Canadian equities could be a reasonable choice for investors, relative to taking an “agnostic” global market-cap-weighted approach with your portfolio. This should at least leave you with data for making a more informed decision for your own portfolio.

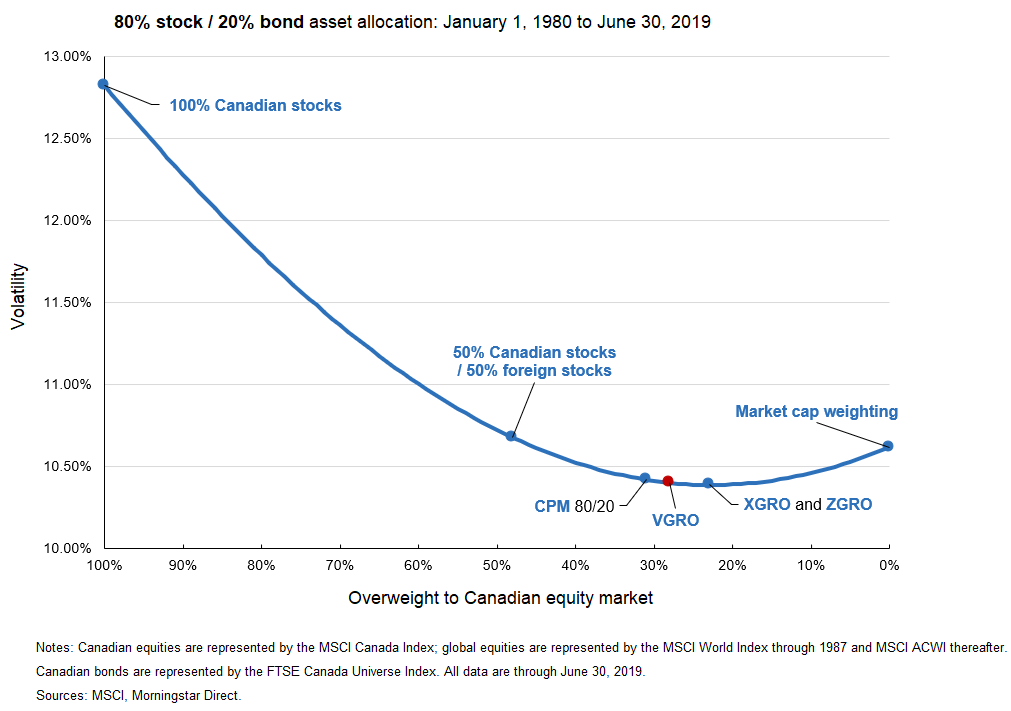

The first reason for overweighting Canadian equities relative to their global market-cap weighting is because this has historically lowered portfolio risk … at least for as far back as I’ve crunched the volatility numbers. For an 80% equity, 20% fixed income asset mix from 1980–June 30, 2019, I found the lowest volatility risk in an equity portfolio holding around 25% Canadian stocks and 75% foreign stocks.

This is similar to how iShares and BMO weight their asset allocation growth ETFs, XGRO and ZGRO, respectively. This minimum-risk portfolio had an average volatility of 10.39% over the measurement period. The average volatility for a global market-cap-weighted growth portfolio (with only around 3% in Canadian stocks), was 10.62%. This portfolio had roughly the same amount of risk as a 50/50 “split of least regret” between Canadian and foreign growth stocks, with an average volatility at 10.68%.

Now, even though a 25% equity allocation to Canadian stocks resulted in the lowest risk for a growth portfolio over this time period, the precise overweighting didn’t seem as critical. Consider the average volatility for a portfolio with a 30% or even a 33% equity allocation to Canadian stocks over the same period. They were all within a few basis points of one another. For example, a 30% equity weighting to Canada (similar to how Vanguard weights VGRO) had an average volatility of 10.40%, or just 0.01% more than a growth portfolio with a 25% equity allocation to Canadian stocks.

Likewise, a 33% equity allocation to Canada (which is similar to our Canadian Couch Potato and Canadian Portfolio Manager model ETF portfolio weightings) increased the average volatility by just three basis points, to around 10.42%. All of these figures were within spitting distance of one another, so they could also be considered “optimal” from a historical risk perspective. They all exhibited much less risk than a growth portfolio invested entirely in Canadian stocks, which boasted a volatility of 12.82%.

Based on these results, I think it’s safe to say that Canadian investors should consider allocating at least half of their equity allocation to foreign equities, and probably more, while at the same time recognizing they can have too much of a good thing.

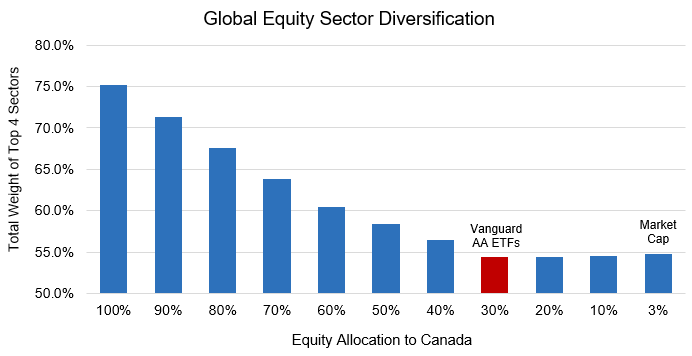

The second reason to consider allocating 30% of your equities to Canadian stocks is because this level of exposure leads to a more diversified sector exposure. The Canadian stock market is overexposed to four sectors: financials, energy, materials, and industrials. These sectors make up around 75% of our domestic stock market. In comparison, the global stock market has a 37.5% weighting to these four sectors, or only half as much exposure.

As we include more foreign stocks into a Canadian-heavy portfolio, the total weight of the top 4 sectors continues to decrease until bottoming out at around 54–55%. This occurs when the split between Canadian and foreign stocks is 30%/70% respectively, i.e., the same split found in Vanguard’s asset allocation ETFs.

Even if we continue to move to a global market-cap-weighted approach by adding more foreign stocks and leaving Canada at around 3%, the grand total of the top 4 sector weights barely budge. This is because the energy and materials sectors just get swapped out for more companies in the information technology and healthcare sectors.

If you have a preference for these hipper tech and drug companies, maybe a global market-cap-weighted portfolio is for you. However, know that you’re still getting decent sector diversification with only a 70% weighting to foreign stocks.

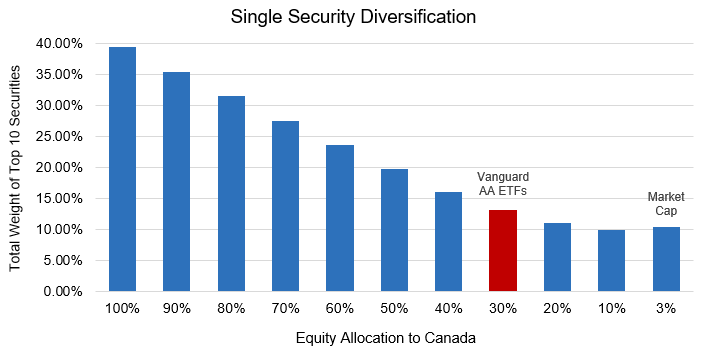

A third reason for allocating about 30% of your equities to Canadian stocks is because the single security risk in your portfolio is largely mitigated at this level. The total weight of the top 10 stocks in Vanguard’s Canadian equity ETF currently accounts for nearly 40% of the fund, with 4 of the big 5 banks accounting for around half of this weight. By splitting your equities into 30% Canadian stocks and 70% foreign stocks, the total weight of the largest 10 stocks in your portfolio drops to around 13%. Sure, you could reduce this figure to about 10% if you were to allocate only 3% to Canadian stocks and 97% to foreign stocks (similar to a global market-cap weighting), but a 30% Canadian equity weighting already provides substantial single security diversification, relative to holding only Canadian stocks.

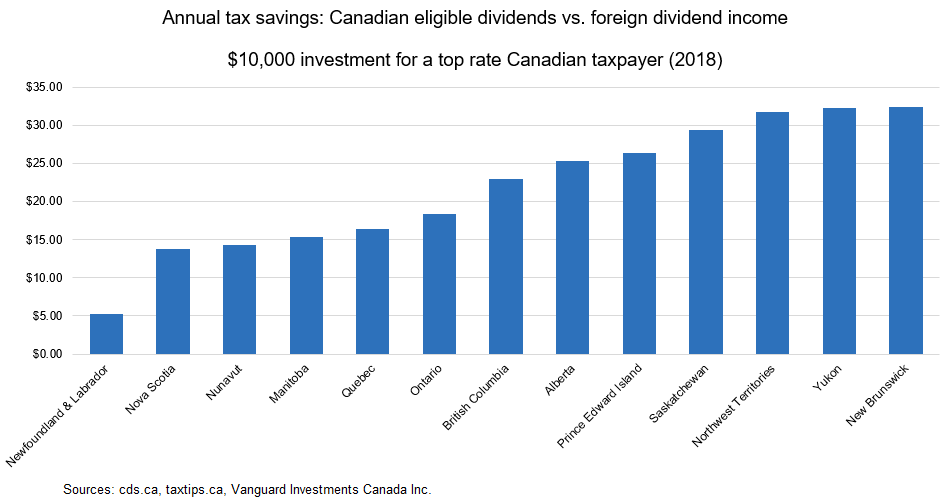

A fourth reason to have more Canadian equities in your portfolio is because Canadian dividends are extremely tax efficient, relative to the dividend income distributed by foreign equities. In 2018, a top-rate taxpayer in Ontario would have saved over $18 in taxes if they had invested $10,000 in Vanguard’s Canadian equity ETF, rather than in a collection of Vanguard’s foreign equity ETFs. This assumes investing in a non-registered account.

However, the tax savings are not equal across provinces. A top-rate taxpayer in Newfoundland or Labrador would have less incentive to overweight Canada in their portfolio, as the tax benefit was only around $5 last year. On the other hand, a top-rate taxpayer in New Brunswick may have even more reason for a Canadian-heavy portfolio, as their tax savings was around $32 in 2018.

Regardless of your income level or home province, most taxable investors across Canada can justify overweighting their stock portfolio with Canadian stocks (beyond the 3% global market cap).

Unfortunately, if you’re not a taxable investor, and all your investments are in TFSAs and RRSPs, you still have to worry about withholding taxes on your foreign dividends. For Vanguard’s 100% equity ETF (VEQT), the tax drag is around 0.25% each year, or about $25 on a $10,000 investment.

If Vanguard had opted for a global market-cap weighting, with Canada at 3% and foreign equities at 97%, this foreign withholding tax drag would have increased to 0.34% per year, or about 0.09% more than its current set-up. Just remember: The higher the foreign equity allocation in your Vanguard asset allocation ETF, the higher the foreign dividend withholding tax drag in your TFSA and RRSP accounts.

Fifth and finally, we should consider our own behavioural biases – especially recency bias, or our tendency to assume recent performance is going to last forever.

When I started at PWL Capital over a decade ago, investors hated U.S. stocks. I would hear things like, “The U.S. stock market is dead”, and “Why don’t I invest more in Canadian stocks?”

That was behavioural bias at work. Over the decade 1999–2008, Canadian stocks had outperformed U.S. stocks by 9% per year on average. U.S. stocks actually lost almost 4% each year on average in Canadian dollars over that truly “lost decade”. No wonder everyone wanted to dump their “losing” U.S. stocks and load up on our winning Canadian ones.

Many of you probably remember what happened over the next 10 years. U.S. stocks roared back to life. They returned over 14% on average each year, outperforming Canadian stocks by 6.5% annually. Once again, behavioural bias colored the narrative, causing many investors to reverse course to, “Why am I investing so much in Canadians stocks?”

| Asset Class | Index | 1999-2008 | 2009-2018 |

|---|---|---|---|

| Canadian Stocks | S&P/TSX Composite Index | +5.34% | +7.92% |

| U.S. Stocks | S&P 500 Index | -3.63% | +14.43% |

| Difference | +8.97% | -6.51 |

I’m certainly not trying to predict which stock market will outperform over the next decade. I just want to bring some unbiased perspective to your decision-making. If you want to invest in a global market-cap weighting for reasons that have absolutely nothing to do with recent stock market performance, and you promise to stick with it (even if Canadian stocks significantly outperform foreign stocks), I think that’s fine. But if you’re comfortable with the four other benefits I just described for overweighting Canadian stocks within your stock portfolio, that’s fine too. Can you live with a 30% Canadian, 70% foreign stock allocation, and stick with the simplicity of a one-fund portfolio? That’s all the better for your Canadian home bias.