By now, you should be more familiar with the equity ETF offerings from Vanguard and iShares. But you may still feel uncomfortable building and managing a portfolio of ETFs on your own.

For example, how much of your portfolio should you allocate to Canadian vs. foreign equity ETFs? And when should you rebalance these allocations?

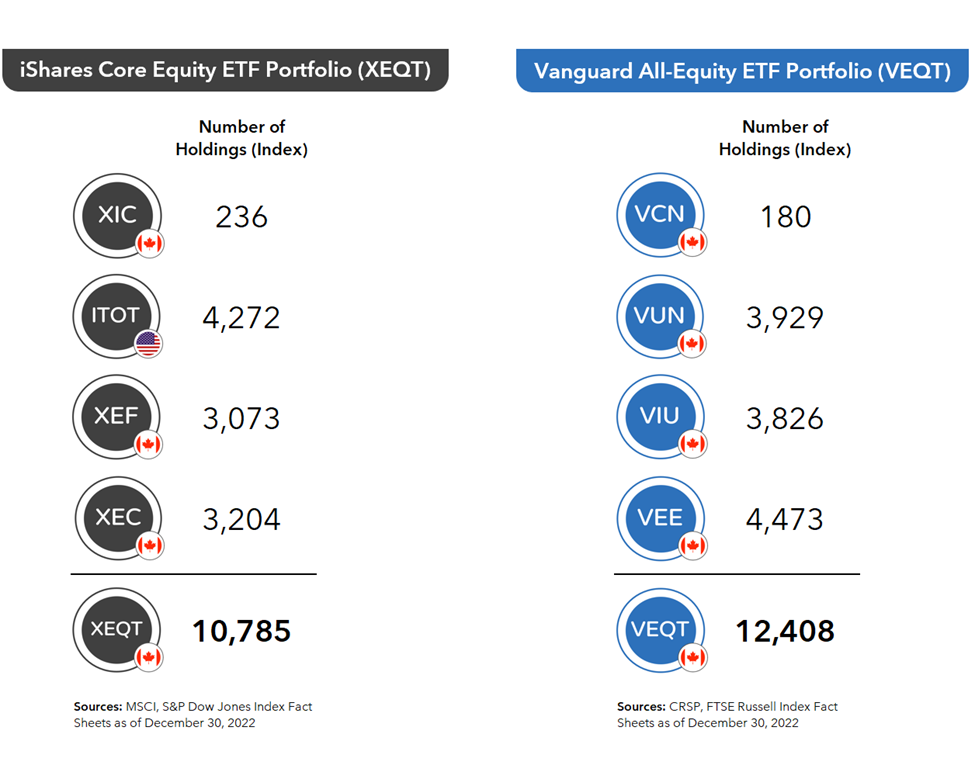

Not to worry. If you’re comfortable dialing up your portfolio risk to 11 with an all-equity risk exposure, Vanguard and iShares have you covered, with the Vanguard All-Equity ETF Portfolio (with ticker symbol VEQT) and the iShares Core Equity ETF Portfolio (with ticker symbol XEQT). Each of these funds include several underlying equity ETFs you’ll recognize from our past videos. And each tracks the performance of thousands of individual companies, providing bold Canadian investors with extensive global equity diversification through a single trade.

There are a few minor variations between XEQT and VEQT, which we’ll cover next. If any of these differences tilt your scale, go for it. Otherwise, a coin flip may be fine.

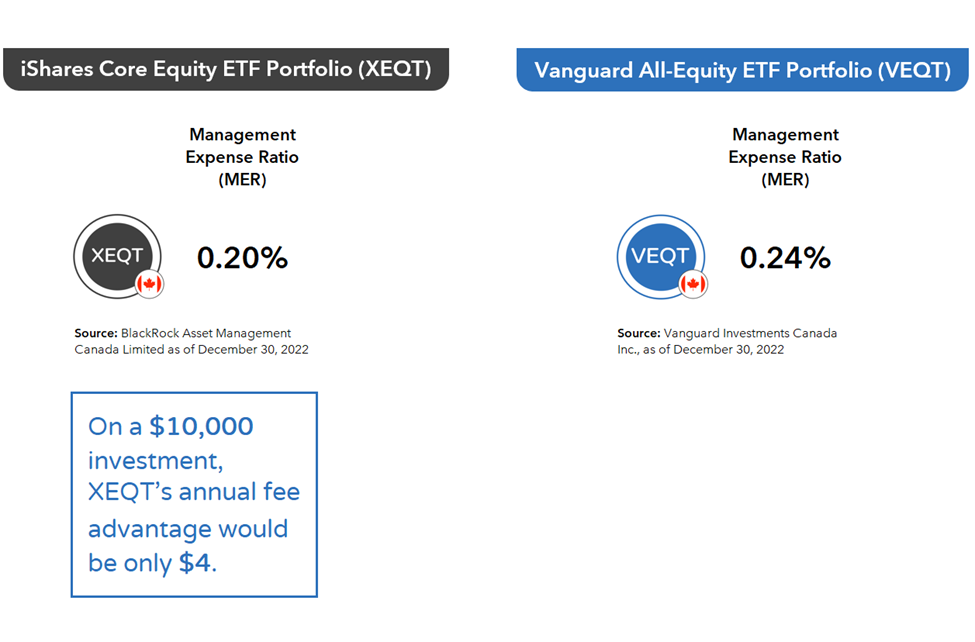

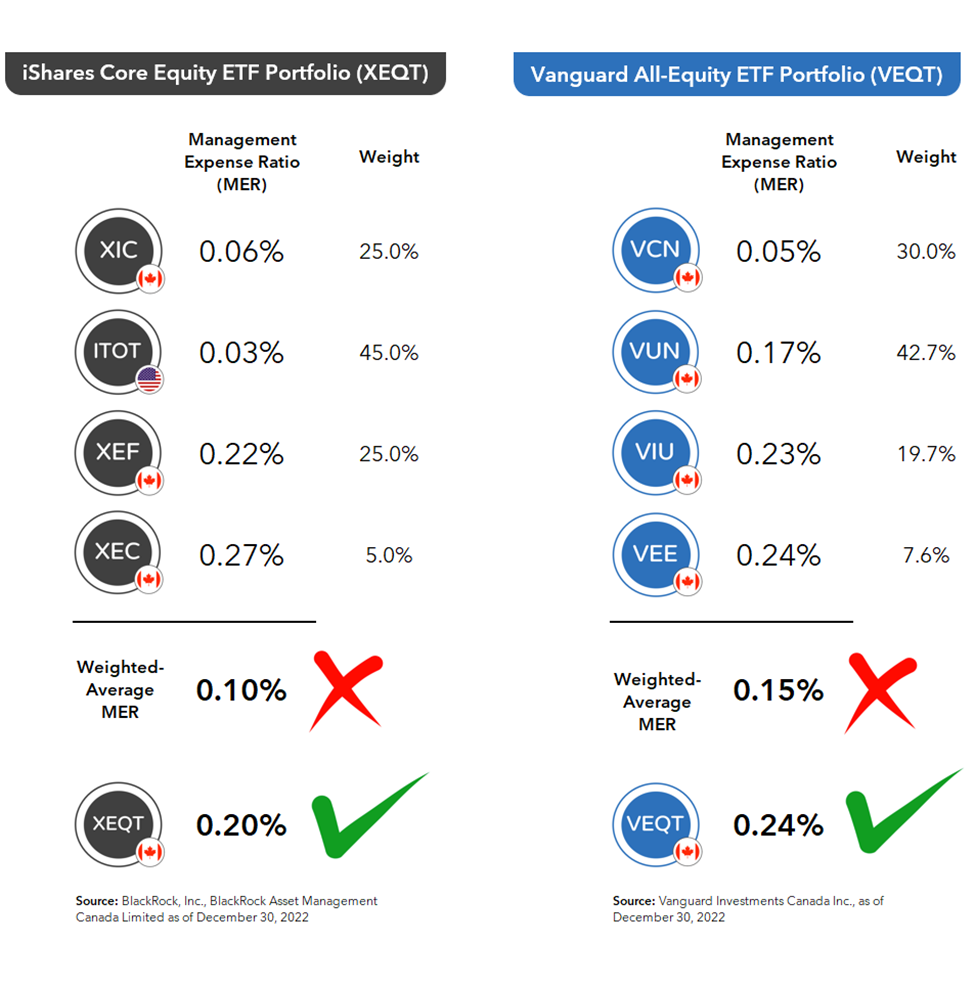

First, there are the annual fees. XEQT has a slightly lower management expense ratio (or MER), compared withVEQT. But it’s so slight, it’s hardly a sufficient reason to prefer one fund over the other, especially in a smaller portfolio. For example, for a $10,000 investment, XEQT’s annual fee advantage would be modest.

I also want to ensure investors understand that these MERs are not in addition to the MERs of the underlying individual ETFs – you do not pay both. So there are no double-dipping fee shenanigans going on with XEQT or VEQT.

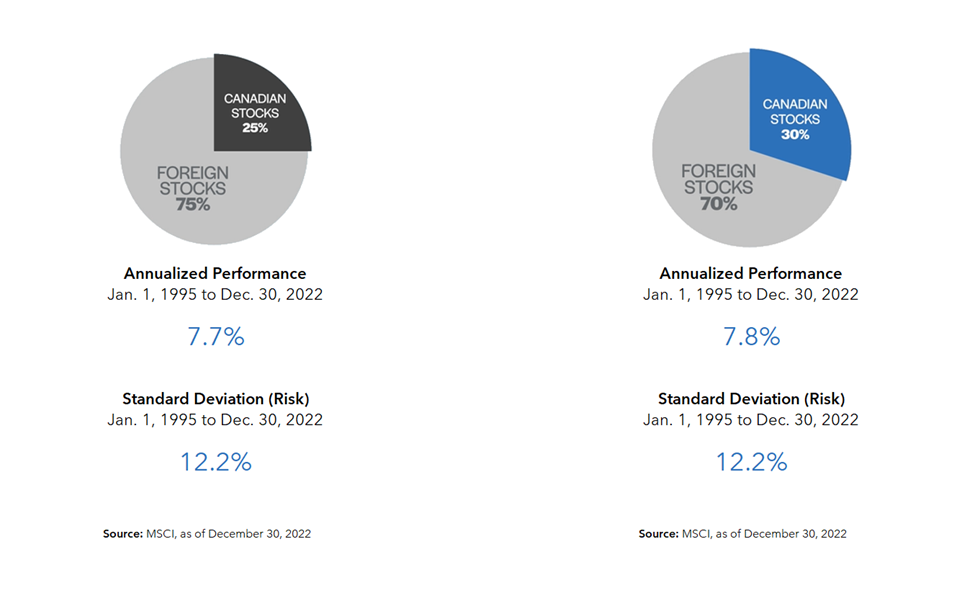

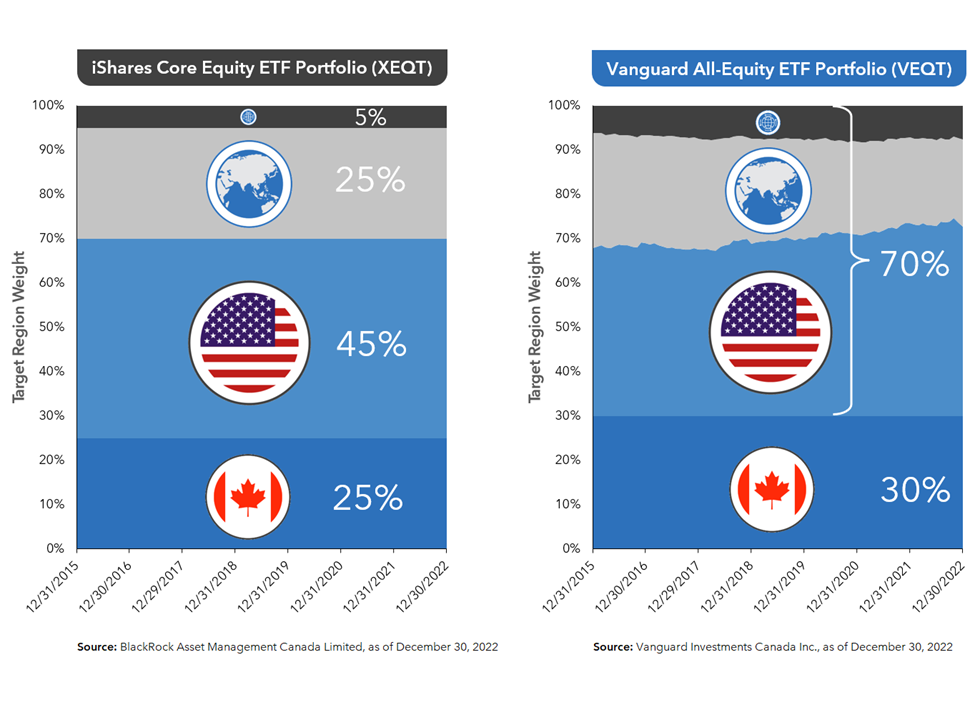

Next, there is each fund’s Canadian equity allocation. Canadian stocks make up only around 3% of the global stock market, but both funds have a higher weight to them in their portfolios. iShares has allocated 25% to Canadian stocks in its all-equity ETF, while Vanguard’s has a 30% allocation.

Either way, a 5% difference in Canadian stocks isn’t likely to have a noticeable long-term impact on your portfolio’s risk or returns. For example, if you had invested in either a 25% or 30% Canadian stock allocation since 1995, it would have made little difference to your portfolio’s risk or returns. In other words, this difference probably isn’t worth agonizing over.

And how about how each fund manages its foreign equity allocations?

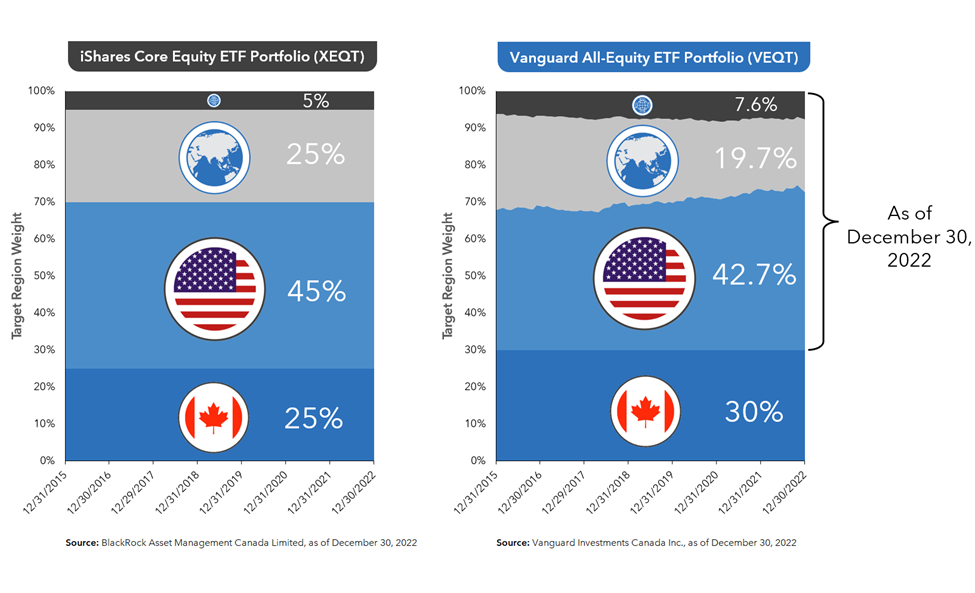

Like its 25% Canadian equity allocation, iShares has also chosen specific target weights for its U.S., international, and emerging markets stock allocations.

U.S. equities receive a 45% share, with another 25% allocated to international equities. The remaining 5% is allocated to emerging stock markets. iShares rebalances back to these target weights, regardless of what global stock markets are up to on any given day.

Similar to iShares, Vanguard’s 30% Canadian stock allocation is also static, so its weight within VEQT is essentially set in stone.

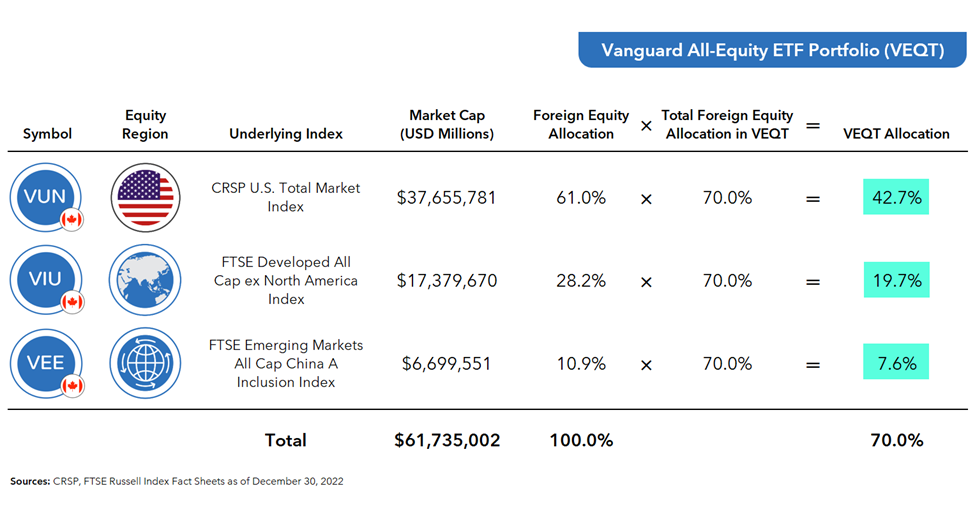

However, VEQT’s U.S., international, and emerging markets equity allocations are more fluid, as they are based on each region’s current stock market value, or market cap. This means that each asset class is free to fluctuate within the constraints of the overall 70% foreign equity allocation, based on the relative stock market values of each region at any point in time.

For example, if we wanted to calculate VEQT’s target foreign equity allocations at the end of last year, we would start by collecting the market caps of the indexes tracked by their underlying U.S., international, and emerging stock market ETFs. These figures can be found on each fund’s monthly or quarterly index fact sheets. Then, we would divide each region’s individual market cap by the total of all three, and multiply each result by VEQT’s 70% total foreign equity allocation. The results would provide us with the year-end target weights within the fund.

You’ll notice, relative to Vanguard, most of iShares’ 5% underweight to Canadian stocks has been reallocated to international stock markets. There are also some small differences in the U.S. and emerging markets equity weights. But again, nothing to lose sleep over.

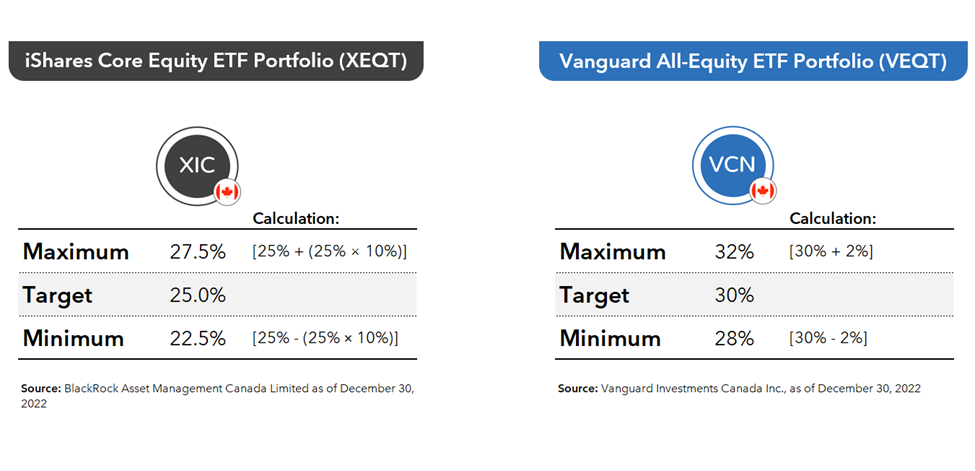

Last up, let’s look at the minor differences between Vanguard’s vs. iShares’ rebalancing thresholds.

iShares plans to rebalance anytime an asset class drifts more or less than 10% of its target weight in either direction. For example, XEQT has a Canadian equities target of 25%, invested in the iShares Core S&P/TSX Capped Composite Index ETF (XIC).

If XIC becomes more than 27.5% of the portfolio [which is calculated as 25% + (25% × 10%)], the managers will likely sell a portion to bring the asset class back in line with its target.

Likewise, if XIC becomes less than 22.5% of the portfolio [which is calculated as 25% – (25% × 10%)], iShares will likely sell a portion of any overweight ETFs, and use the proceeds to buy more XIC.

In practice, iShares will typically prioritize using new cash flows to top-up any underweight asset classes. This should reduce the need to rebalance by selling appreciated securities, which could be taxable to the ETF’s unitholders.

Vanguard’s rebalancing plan is a little different. They won’t allow any specific fund to deviate by more or less than 2 percentage points from its target weight. For example, VEQT has a Canadian equities target weight of 30%, invested in the Vanguard FTSE Canada All Cap Index ETF (VCN). If VCN becomes more than 32% of the portfolio (30% + 2%), or less than 28% (30% – 2%), Vanguard will likely spring into rebalancing action. Again, they’re more likely to use new cash flows to top-up any underweight asset classes, reducing the need to sell existing securities.

So, which is right for you: XEQT or VEQT? By now, I hope you’ve realized, if an all-equity ETF makes sense for you to begin with, either offering would be an acceptable choice. None of the minor variations in their annual fees, Canadian and foreign equity allocations, and rebalancing protocols create a clear edge either way. If you prefer one over the other based on the factors I’ve discussed here, great. If not, flip a coin. Heads or tails, you win.